Start Up Grants Available in NSW

When starting up a new business, one of the key issues is funding. How are you going to get enough money together to not only start your business, but ensure you have enough cash flow for the first year or two until it is profitable? If you're in New South Wales,...

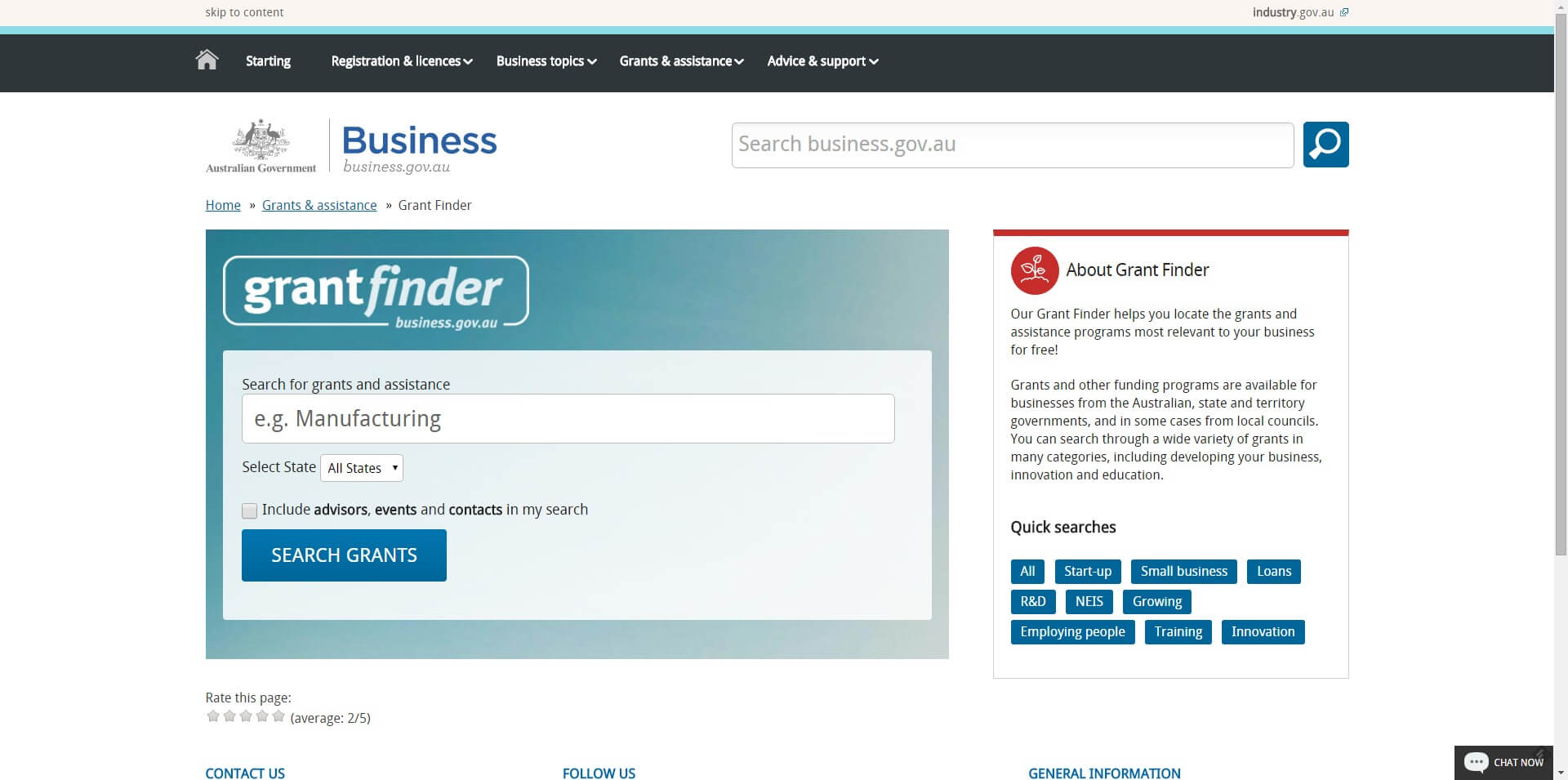

Grants and Programs Finder

If you haven't yet discovered the business.gov.au Grants & Programs Finder tool, then you have been missing out! Grants and other funding programs are available from the Australian, state and territory governments and in some cases from local councils. Generally...

Time for change: Australia’s rise in ethical investment

Investing your cash is all about making money, right? When you're pouring over the rise and fall of the markets and picking out the best ASX 200 futures you just want to spot something that will make those dollars multiply. But what about where your money goes? Do you...

Startup Incubators and Accelerators in Australia

Here you’ll find the first, full, regularly updated list and directory of all the incubators and startup accelerators across Australia. If you’re looking to take your idea or company to the next level, Great roundup from TheFetchBlog NSW Startmate | @startmate Sydney...