One of the most confusing things about running a business in Australia is whether or not you need to charge GST on your invoices. You may think that just because you have an ABN (Australian Business Number) and people are charging you GST that you need to do the same, however there are some very strict rules to follow.

The Goods and Services Tax (GST) is a tax of 10% on most goods and services sold in Australia. If your business has a turnover of $75,000 or more ($150,000 for non-profits) or you provide taxi services, then you must register for and charge GST on eligible good and services. You must also provide tax invoices for your taxable sales. Any GST charged and collected needs to be put aside and paid to the Australian Tax Office (ATO).

GST is something you don’t want to get wrong in your business. It’s important to know what GST is, when you need to be registered for it, when to charge it and on what goods and services, and how to report and pay your GST obligations to the ATO. Stuffing it up could mean that you will need to payback extra tax that you’re not ready for, severely denting your cash flow.

When to register for GST

You must register for GST when the turnover in your business reaches $75,000 in a 12-month period or if you expect your turnover to be more than that in the next 12 months. This amount is $150,000 for non-profit organisations. A common misconception is that the turnover needs to be over the financial year, however it is actually any 12-month period, so you need to take into consideration the current month and the previous 11 months. Turnover in regards to GST is gross revenue, not profit.

You will also need to register for GST if you are providing taxi or rideshare services like Uber. This is regardless of how much turnover you have. Registration is optional if none of these things apply to you. You can register for GST through the government’s Business Portal with your ABN.

Charging GST and invoicing

Most goods and services will attract GST. However there are some exceptions that are classified as GST free sales. These are things like basic food, some medical service and products and other necessary services. You can find out when to charge GST and not on the ATO website.

GST in Australia is currently 10% of the sale price to customers. This means if you want your price for something to be $50, you then need to add 10%, making the final price to the customer $55. The $5 charged as GST would need to be set aside to pay to the ATO. If you wanted to charge the customer $50 for something, then you would need to work out the GST of 10%. You can do this by dividing the price by 11, giving you a GST of $4.54 in this case.

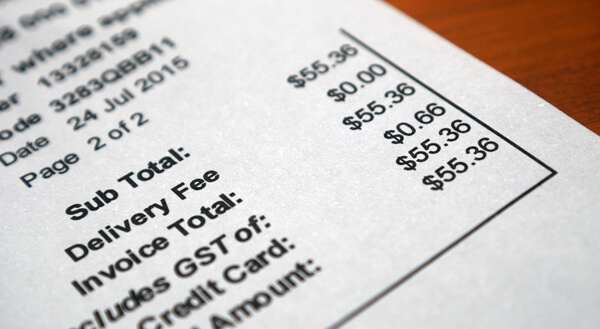

If you do charge GST, you must provide the customer with a tax invoice if the amount (including GST) is over $82.50. You must also provide a tax invoice if the customer asks for one. These invoices must include certain information being:

- That the document is tax invoice

- The seller’s identity and Australian business number (ABN)

- The date the invoice was issued

- A brief description of the items sold, including the quantity (if applicable) and the price

- The GST amount (if any) payable – this can be shown separately or, if the GST amount is exactly one-eleventh of the total price, such as a statement which says ‘Total price includes GST’

- Whether each sale on the invoice is a taxable sale (that is, if each sale on the invoice includes GST).

Tax invoices of $1000 or more also require the buyer’s identity or ABN. You can find more about invoice obligations on the ATO website.

Claiming a GST credit

You need to charge GST if you are registered for it, but you can also claim a credit for any GST that is charged to you on any purchases for your business. You must be registered for GST to claim GST credits. If the purchase is more than $82.50 you must have a tax invoice to claim the GST. You will still need a receipt or similar for purchased less than that amount.

You can only claim GST credits on purchases for your business. If your purchase is for both business and personal use, then you can only claim a part credit for the part that is business use. You cannot claim GST credits if you are not registered for GST, if there is no GST in the purchase cost, or if you don’t have a tax invoice for purchases over $82.50.

Claiming GST credits is done on your Business Activity Statement.

Accounting for GST

If you are going to be registering for GST, you will need to make sure you are invoicing correctly and keeping track of all GST collected to be paid to the ATO through your Business Activity Statement (BAS). A BAS works by recording the amount of GST collected and amount of GST you are claiming for a credit. If the GST your collect is more than the credits you are paying then you pay the difference. Most businesses do their BAS every 3 months.

Keeping good records helps you stay on top of your business, cash flow and GST. Some businesses do this through accounting software to keep track, and others keep GST collected in a separate bank account, so they have it available when needed.

It’s important to keep track of when you need to register for GST and do so accordingly. Also keep accurate records to ensure you can report and pay your GST obligations. Doing so will save you a lot of trouble down the track including penalties and paying back the GST you should have charged.