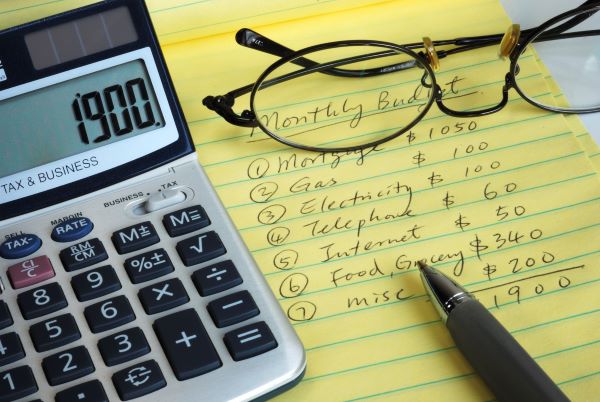

Managing money and finances can be hard – especially if you’ve never been taught ways to do it. If you are struggling to keep on top of your finances learning how to create and stick to a family budget is a good place to start.

Budgeting won’t earn you any extra money but it will keep track of where the money you do earn is going. Having a budget can also allow you to be more stress free as it gives you a clear path of what you need to spend money on and how much you have available.

Whether you are needing to find some money for something specific or you just want to organise some financial priorities it might be time to sit down and work out a family budget – and stick to it.

Creating a family budget

Budgets can be created for many reasons. You might be changing jobs and will have different pay, figuring out if one partner can become a stay at home parent, having another child, working out if you can afford to start a business, or just want to keep track of your spending. Budgeting is a great tool to save you money and live a more financially relaxed life.

To start a budget, you need to know how much you earn and how much you spend. Sit down with you partner (if you have one) so you are both working on your budget together. Log into your bank accounts when doing your budget so you can get accurate amounts.

Step 1 – Income

You need to work out the total income coming in to you or your family. This includes

- you and your partners work income (after taxes)

- bonuses

- income from savings or investments

- Centrelink or family benefits

- child support

- any other income coming in

Add it all together to get your total income amount.

Step 2 – Expenses

You need to properly look at all your expenses. This is everything you spend money on. Most people think of the big things like rent or mortgage, utilities, phone etc but it’s the little things that can really add up such as a daily coffee, purchasing lunch, or the quick run to the shops that ends up in extra groceries or random Kmart items.

It is good to sort your expenses into like-minded categories such as:

Financial commitments

- mortgage or rent

- loan repayments such as a car or personal loan

- credit card interest

- voluntary super contributions

- savings

- child support payments

- charity donations

Home and utilities

- council rates

- body corporate fees

- insurance (home and contents)

- home maintenance / repairs

- new furniture or appliances

- electricity

- gas

- phone

- internet

- pay tv

Education

- School fees

- Daycare fees

- Uni / Tafe

- School uniforms

- After school activities / sport

Health

- Private health insurance

- Life insurance

- Doctors

- Dentist

- Medicine / pharmacy

- Eyecare / glasses

- Gym membership

- Vet

Transport

- Car insurance

- Car maintenance

- Car rego / licence

- Petrol

- Road tolls / parking

- Public transport

Shopping

- Supermarket / groceries

- Clothing / shoes

- Cosmetics / toiletries

- Baby products

- Hairdresser

- Gifts

Eating Out

- Restaurants

- Take away / snacks

- Bought lunches

- Coffee / tea

Entertainment

- Holidays

- Bars / clubs

- Alcohol

- Sports membership

- Movies / music

- Hobbies

- Newspapers / magazines

- Celebrations

- Cigarettes

If you are someone that mostly uses their card to pay for purchases then it is easy to go through your bank statements to see where you have spent your money and enter it into your budget accordingly. If you tend to spend more cash, then for the next month write down everything you spend or keep all your receipts so you can go through them.

A great budget template to get you started can be found here.

Step 3 – Compare your income and expenses

Now it is time to see how you are tracking. Take your total income and minus your total expenses. Are your expenses more than your income or do you have money left over?

If you have money left over does the amount your budget says you should have correlate to what you actually have left in your bank account at the end of the month? If it doesn’t seem to add up then double check that you aren’t missing expenses. Things like getting cash out and paying for stuff that way can sometimes be missed in a budget.

Step 4 – Set some financial goals

When doing your budget, it is a good idea to set up some financial goals. Things like paying off your credit cards, putting extra money on your mortgage, saving for a holiday, paying for your kids’ education or even a new car. Having a goal gives you an incentive to stick to your budget.

Step 5 – Look at ways to reduce your expenses

If you are wanting to budget to save money, of if your income is less than your expenses, once you have everything entered look critically at where you are spending your money. Are there ways to make savings? There are always some expenses that can’t be reduced, but there are plenty that can. Do you really need Netflix and Stan? When was the last time you checked whether you can get a better deal on your insurances? Are you actually using the gym membership you’re paying for? If you’re not on a fixed mortgage rate ring your bank to see if they can give you a lower one (especially in the 2020 climate).

You will be surprised how quickly little amounts add up to some big savings which means more money in your pocket or to get to your financial goal.

Step 6 – Review your budget

The first month you have after making your budget make sure you review it at the end to see that your expenses line up to what you entered. Then every few months sit down and check that what you are spending is what is in your budget. If there are areas you are overspending then you need to either adjust your budget or really watch your spending in those areas. Regularly reviewing your budget will keep you on track and let you know that you can meet your financial goal, or even splurge on something.

Having an emergency fund

For financial piece of mind, some people like to have an emergency fund, which is a sum of money in a separate account that is only to be used in emergencies such as redundancy. The amount of money needed varies for everyone, but it is generally advisable to have at least 3 months’ worth of expenses saved.

This may not mean that you need all of your expenses in an emergency situation, so it could be a smaller amount than you might think. If you lose your job, for example, then most people will get rid of extra non-essential expenses (things such as Netflix) fairly quickly to save some money.

This fund can also be used for things like unexpected repairs on your house or car (that are not already covered in your budget under general maintenance) or even things like last minute flights to attend a funeral.

It is a good safety net to have for true emergencies and can give you a bit of financial breathing room – provided you aren’t taking money out of it for other things.

Tips for sticking to a budget

Some people hate budgeting and that’s ok, but if you want to really keep ahead of your finances you need to create a budget and stick to it. This is harder for some people than others. Here are a few hints and tips to keep you on track.

Keep it realistic

Ok, so it might be fantastic to budget that you’re only going to spend $100 a fortnight on groceries or not buy clothes for three months but is that actually realistic? Look over your budget critically and see if the amounts you’ve budgeted are actually going to service your needs. You may get better over time and find that you can reduce some amounts, but be realistic about how much you spend in some areas.

Push yourself to spend better and save more—but be realistic when you set up your budget. You’re mush more likely to stick with a budget if your goals are achievable. And you can always reward yourself with something small if you’re under budget or set yourself little challenges along the way.

Meal plan

Sticking to a grocery budget can be hard work, especially when you go shopping without a list or even an idea about what you are going to cook. Plan ahead by working out what you are going to have for meals each day (this can include breakfast, lunch, dinner and snacks) and write out a grocery list for what you need for the week. Check what’s in your fridge and cupboard before you venture out so you’re not buying stuff you already have and don’t shop when you’re hungry. This will help you stay within your grocery budget, which is one of the easiest sections to go over.

Choose less complex meals for days you know you’ll be tired from work, or on days the kids have after school activities. You are more likely to stick to your plan if the meals are quick and easy to do during the week, rather than feeling overwhelmed with what you’d decided and opting for take-away instead.

Have multiple bank accounts

Dividing up your money into separate bank accounts can be a good way to make sure you have enough for expenses. We currently have 3 bank accounts. One for our emergency fund, one for our regular fixed expenses (such as mortgage, utilities, daycare, school fees etc) and one for our changing expenses like food, clothing and anything ‘fun’. This last account is our day to day one and is the only one we allow ourselves to take money from for expenses that aren’t in our budget. This way we have no chance of running out of money for our fixed expenses during the month.

Grab your drinks at home

Coffee, bottles of water and soft drinks during the work day are money suckers. Yes it’s convenient to get a drink from the local shop down the road, but it is much more expensive than bringing one from home.

Get yourself a keep cup and make your morning coffee at home. Take it with you in the car and save yourself from grabbing your first one on the way to work. Bring a reusable water bottle with you wherever you go and fill it up with a tap instead of purchasing water (this is also a great way to keep bottles out of landfill). Even look at buying soft drink cans or bottles from the supermarket and bring them with you. They are much cheaper to buy at a supermarket than individually from a café.

Get rid of your credit card

Credit cards make it very easy to overspend on your budget. You are also spending money you don’t have. You are less likely to impulse buy if you don’t have a credit card as you actually need to think about whether you have the money available to purchase something. Credit card interest is always ridiculously high and if you really feel like you must have one then leave it in a safe at home so you can’t use it for everyday purchases.

Give yourself an allowance

If you have a little bit of surplus funds in your budget, then give yourself (and your partner) a little bit of ‘fun’ money. This is a certain amount that you can spend on anything without feeling guilty. Once that amount is gone, then that’s it for the month.

Track your spending

It’s a good idea to track your spending for a few months to see what’s going on. This means everything from big monthly bills to every coffee purchase. There are a heap of apps that will help you do this and it’s a great way to really get a feel as to whether you’re sticking to your budget and where you might be splurging a bit too much. This is also a good tool if your actual purchases aren’t matching up to your budget.

Don’t forget yearly bills

It’s easy to create a budget for monthly stuff – groceries, phone, rent etc but have you remembered the stuff that comes out yearly? Things like car rego, insurance and other stuff you may only pay once a year, but you need to budget for, so you have the money available.

Creating and sticking to a budget means being aware of how quickly money can be spent and then doing something about it. It doesn’t mean you can’t have fun, or eat out, but it does mean paying conscious attention to where your money is going.

If you can be frugal (which is not the same thing as just being cheap) then you’ll start to get to the end of the month with money to spare. This means your financial goals can not only be achieved, but quickly. If that sounds exciting, then starting a budget might just be a great move for you.